Stocks Catching Up To Yields And The Dollar In Repricing The Fed

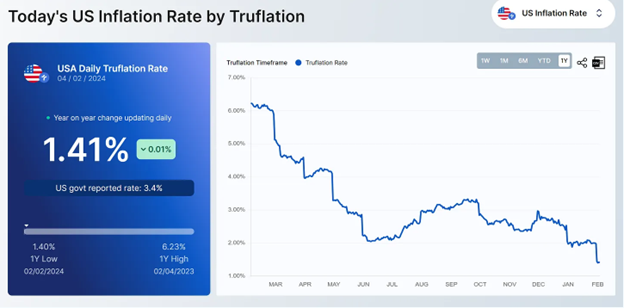

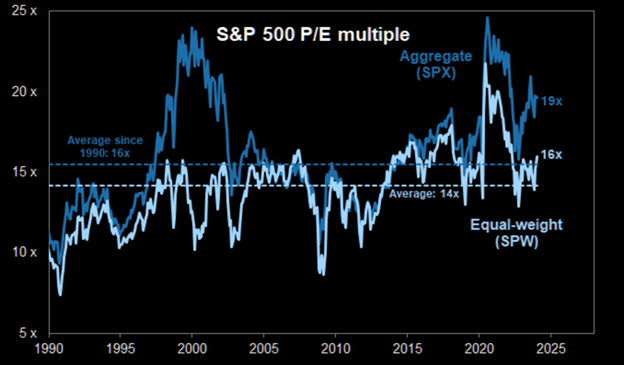

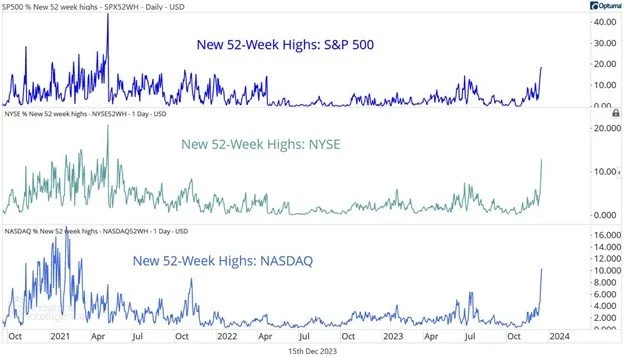

Correction has pushed the slide in the S&P 500 beyond the -5% level. The fall in the momentum driven Nasdaq has been even steeper. Fed rate cut expectations are down to less than two cuts in 2024 – yields and the U.S. dollar have already repriced this reality. Stocks are catching up. Gold looks like it might give investors who are underexposed an opportunity to size up as it undergoes a correction.

The Return Of The “Fed Put” Is Supporting Stocks

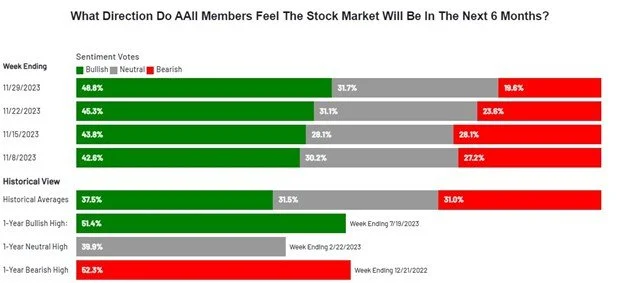

Fed fund futures pricing is down to less than three rate cuts for 2024. Gold continues to shine – rising in 6 of the past 7 weeks. Being bullish, while not wrong, is not a unique view at the moment.

Long-end Of The Yield Curve Presenting A Problem

Gold beating to its own drum. Sadly, Herbert Hoover was right, “Blessed are the young, for they shall inherit the national debt.” Long-end of the yield curve is starting to act unhinged again, similar to October 2022 and October 2023 when price action in risk assets was dicey.

Structural Dilemma For Policymakers And Investors

Powell continues to play it down the middle of the fairway while having a dovish bias. Structurally expanding deficits are forcing policymakers and investors to adapt. A look at how real assets have performed over the past thirty years.

Fed Credibility On Watch

Green shots out of China giving a lift to commodities. Will the Fed guide to even less rate cuts at Wednesday’s Fed meeting. Swing and a miss – California job growth restated by 85%.

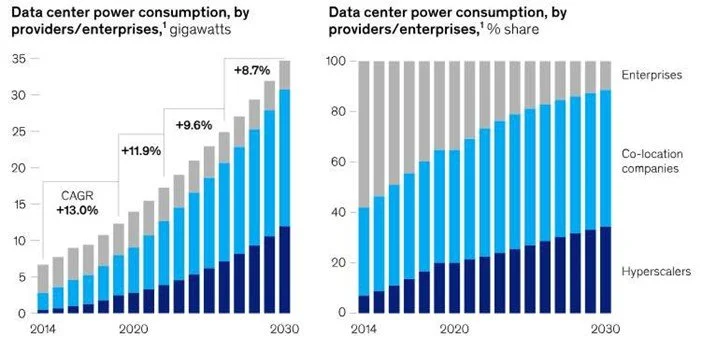

Where’s The Power

• China is leading Asian equities higher.

• U.S. assets have become the world’s savings account.

• Where do we get the power?