The Air Is Getting Thinner Up Here

• Growth to value rotation underway.

• Will it have legs? I have my doubts.

• Recession risks on the rise as the ‘margin of safety’ in the equity market erodes.

• The BIS highlights a structural risk that all investors should take note of.

Pressures Building

• A lot going on, but not much happening.

• Oil prices, U.S. dollar index, and interest rates all on the rise – bad mix for risk assets.

• Bonds more concerning than equities with existing structural forces.

The Madness of Crowds

• Subtle signs of a growth to value rotation percolating.

• Will it last? I have my doubts; the structural dynamics fueling excessive concentration remain too strong.

• Households' exposure to the equity market is unnerving.

• Copper and uranium presenting a buying opportunity.

Unhealthy Internals Masked By The Trillion-Dollar Club

• S&P 500 gained +1.6% last week, with 315 constituents declining.

• Not much new coming out of the Fed meeting.

• Don’t abandon investment principles that have proven to withstand the test of time.

Quality Over Quantity

The performance difference between owning Mega-Cap Tech and not is drastic. Better than expected jobs report shifts Fed rate cut expectations. Inflation report and Fed meeting highlight this week's key events. Last week, investors decided we don’t need commodities in the future (sarcasm intended).

Some Random Thoughts

• Risk/reward in equities and credit at unfavorable levels

• Energy stocks relative to tech stocks look interesting

• Most market observers are missing or not talking about the popping of the sovereign debt bubble that has transpired over the past three years.

Some Investment Themes With Staying Power

• Softer-than-expected inflation readings boost stocks, bonds, and commodities.

• There is just too much debt.

• Some investment themes with staying power.

A Lot Going On, But Little To Do

• Equity rally pushes S&P 500 back up to within 1% of its all-time high

• Corporate profits are improving and so is CEO confidence

• Big weak of U.S. economic data, headlined by inflation reports on Tuesday and Wednesday

Time To Monitor The Labor Market More Closely

• Stocks rallied on a less hawkish Fed meeting and weaker than expected jobs report.

• A Fed on hold with a high bar to get more restrictive, solid earnings results, and a cap on interest rates removes a lot of uncertainty for investors.

• Areas that look interesting to us.

Global Economic Upturn Progressing

Equities staged a strong rebound last week and clawed back a major chunk of the correction. Big week of data and earnings – headlined by the Fed, the QRA, the April jobs report, and earnings from Tech giants Amazon and Apple. A global manufacturing upturn is underway. TINA is dead, there are plenty of alternatives to equities today.

Stocks Catching Up To Yields And The Dollar In Repricing The Fed

Correction has pushed the slide in the S&P 500 beyond the -5% level. The fall in the momentum driven Nasdaq has been even steeper. Fed rate cut expectations are down to less than two cuts in 2024 – yields and the U.S. dollar have already repriced this reality. Stocks are catching up. Gold looks like it might give investors who are underexposed an opportunity to size up as it undergoes a correction.

The Return Of The “Fed Put” Is Supporting Stocks

Fed fund futures pricing is down to less than three rate cuts for 2024. Gold continues to shine – rising in 6 of the past 7 weeks. Being bullish, while not wrong, is not a unique view at the moment.

Long-end Of The Yield Curve Presenting A Problem

Gold beating to its own drum. Sadly, Herbert Hoover was right, “Blessed are the young, for they shall inherit the national debt.” Long-end of the yield curve is starting to act unhinged again, similar to October 2022 and October 2023 when price action in risk assets was dicey.

Structural Dilemma For Policymakers And Investors

Powell continues to play it down the middle of the fairway while having a dovish bias. Structurally expanding deficits are forcing policymakers and investors to adapt. A look at how real assets have performed over the past thirty years.

Fed Credibility On Watch

Green shots out of China giving a lift to commodities. Will the Fed guide to even less rate cuts at Wednesday’s Fed meeting. Swing and a miss – California job growth restated by 85%.

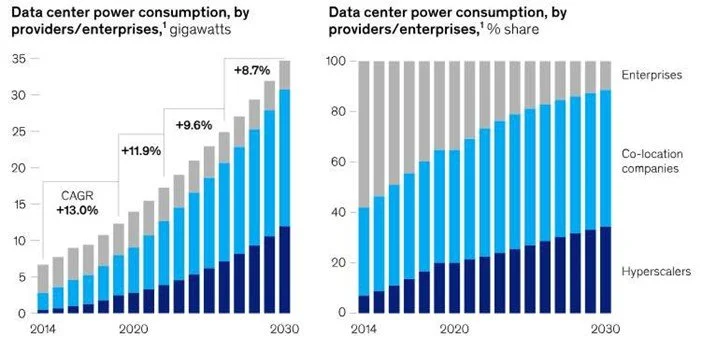

Where’s The Power

• China is leading Asian equities higher.

• U.S. assets have become the world’s savings account.

• Where do we get the power?